Introduction

Investing for beginners works by putting money into assets that can grow or generate income over time, with returns depending on risk, time, and consistency—not luck or quick wins.

Many beginners feel intimidated by investing because online advice jumps straight into stocks, crypto, or complex strategies. In reality, investing is a gradual process built on understanding, patience, and realistic expectations. This guide explains how investing actually works from the ground up—what happens to your money, why risk exists, and how beginners can start safely without chasing trends or overcomplicating decisions.

What investing really means

At its core, investing means:

- You put money into an asset

- That asset has the potential to grow or produce income

- You accept uncertainty in exchange for long-term gains

Unlike saving, investing exposes your money to ups and downs—but rewards patience.

[Expert Warning] What beginners often overlook is that investing is a process, not a one-time decision.

How money grows through investing

Investing works through three main mechanisms:

1) Price growth

Assets like stocks or funds increase in value over time as businesses grow.

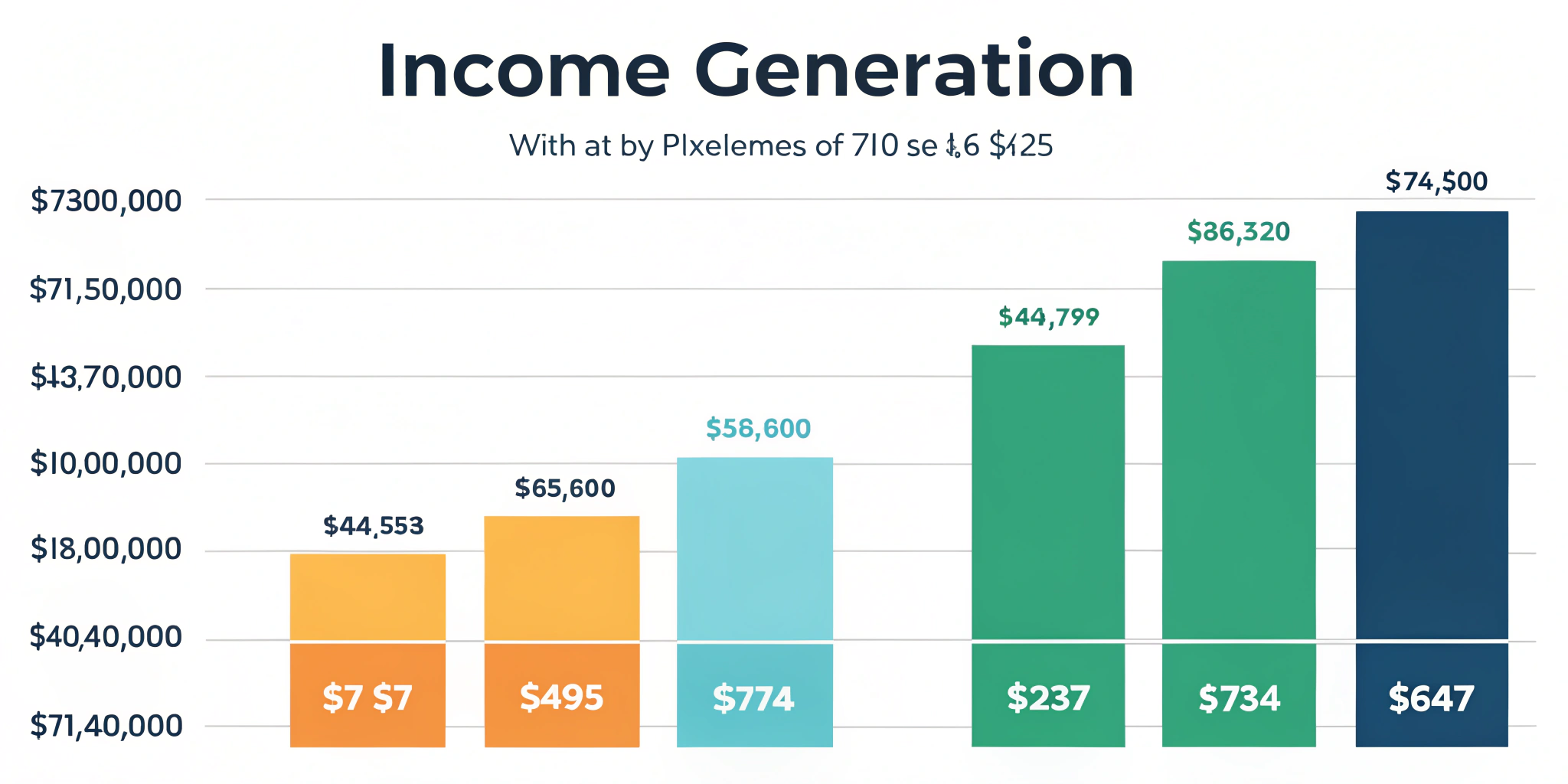

2) Income generation

Some investments pay:

- Dividends

- Interest

- Rental income

3) Compounding

Returns generate more returns when reinvested—this is where long-term growth accelerates.

Why risk exists in investing

Risk exists because:

- Businesses can underperform

- Markets react to uncertainty

- Prices move daily

Higher potential returns usually come with higher volatility.

[Pro-Tip] From real market behavior, risk is not something to eliminate—it’s something to manage.

Common beginner investing mistakes

Mistake: Trying to avoid all risk

Fix: Accept small, controlled risk for long-term growth.

Mistake: Chasing fast profits

Fix: Focus on time in the market, not timing the market.

Mistake: Investing without understanding

Fix: Learn the basics before buying assets.

Mistake: Starting too aggressively

Fix: Begin small and increase as confidence grows.

Information Gain: Investing is about behavior, not intelligence

Top SERP pages focus on asset selection. What they miss is behavioral discipline.

In practice:

- Consistent investors outperform emotional ones

- Simple portfolios beat frequent trading

- Staying invested matters more than “perfect picks”

Your behavior determines results more than your knowledge.

Beginner mistake most people make

The biggest beginner mistake is believing you need to “feel confident” before investing. Confidence usually comes after experience. Starting small builds understanding faster than endless research.

How beginners should start investing

Step 1: Stabilize finances first

Before investing:

- Cover essentials

- Build a small emergency buffer

Step 2: Choose simple investment types

Beginner-friendly options include:

- Broad market funds

- Diversified ETFs

- Low-cost index funds

Step 3: Invest consistently

Small, regular contributions reduce risk and stress.

[Money-Saving Recommendation] Once basics are clear, beginner-friendly investing platforms or tools can automate consistency and reduce emotional decisions.

Table: Saving vs investing (quick comparison)

| Feature | Saving | Investing |

| Risk | Very low | Variable |

| Returns | Low | Medium–High (long term) |

| Purpose | Stability | Growth |

| Time horizon | Short-term | Long-term |

| Volatility | None | Yes |

Real-world scenario: starting investing with limited money

In practical situations, beginners succeed by:

- Investing small monthly amounts

- Ignoring daily market noise

- Staying invested through ups and downs

Consistency matters more than starting amount.

FAQs

How does investing make money?

Through growth, income, and compounding over time.

Is investing risky for beginners?

Yes, but risk can be managed with diversification and patience.

How much money do I need to start investing?

Often very little—consistency matters more than amount.

Can beginners lose all their money?

Unlikely with diversified, long-term investing.

Is investing better than saving?

They serve different purposes—both are important.

How long should beginners invest for?

Conclusion

Investing works best when beginners keep it simple, stay consistent, and focus on long-term growth. You don’t need perfect timing or advanced knowledge—just a clear understanding of risk, patience, and a system you can stick with.

Internal link

Investing Mistakes Beginners Make (And How to Fix Them)

External link