Introduction

Credit card vs debit card is the decision every beginner faces when managing daily spending and building financial habits. One lets you borrow money; the other uses funds you already have.

This distinction affects fees, fraud protection, credit history, and everyday behavior. Many beginners default to debit for safety, while others jump into credit without a plan and risk interest charges. This guide explains how each card works, when each makes sense, common beginner mistakes, and how to use cards as tools—not traps.

How debit cards really work

https://www.youtube.com/watch?

A debit card pulls money directly from your bank account.

What that means in practice:

- Spending is limited to available balance

- No interest charges

- Immediate impact on cash flow

Debit cards are straightforward and help beginners stay within limits—but they come with trade-offs.

[Expert Warning] Debit cards offer less protection if fraud occurs because the money leaves your account immediately.

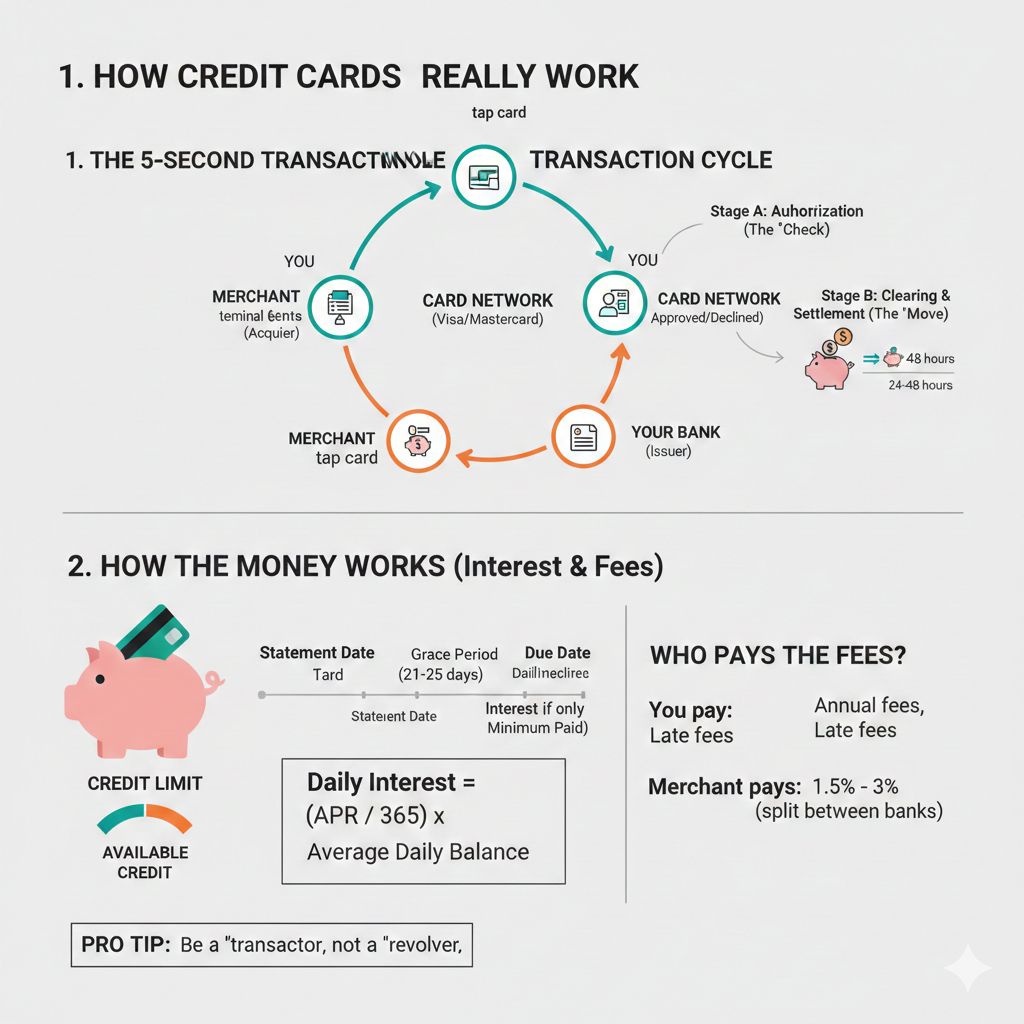

How credit cards really work

A credit card lets you borrow money from the issuer up to a limit.

What that means in practice:

- You pay later (usually monthly)

- Interest applies if you don’t pay in full

- On-time payments can build credit history

Used correctly, credit cards are powerful. Used poorly, they become expensive.

[Pro-Tip] From real usage, beginners who automate full balance payments avoid nearly all credit-card downsides.

The most important differences (that beginners feel)

Cash flow impact

- Debit: Money is gone instantly

- Credit: Cash stays until the bill is due

Fraud protection

- Debit: Slower recovery; funds tied up

- Credit: Stronger protections; easier disputes

Credit building

- Debit: No credit history impact

- Credit: Builds (or damages) credit

Common beginner mistakes (and how to fix them)

Mistake: Using credit cards like extra income

Fix: Treat credit as delayed cash—not new money.

Mistake: Avoiding credit entirely out of fear

Fix: Use a simple credit card for small, planned expenses.

Mistake: Using debit for risky purchases

Fix: Prefer credit for online or large purchases for protection.

Information Gain: The best choice depends on behavior, not features

Most comparison pages list features. What they miss is behavioral fit.

- Debit works best for strict spenders

- Credit works best for organized planners

- Mixing both—intentionally—often works best

Your habits determine outcomes more than the card type.

Real-world scenario: a safe beginner setup

In practical situations, beginners succeed with:

- Debit card for daily spending control

- One basic credit card for subscriptions or fixed bills

- Automatic full payment every month

This builds credit without risking debt.

[Money-Saving Recommendation] Choose cards with no annual fees and clear statements while learning—features matter less than clarity.

Table: Credit card vs debit card (beginner view)

| Feature | Credit Card | Debit Card |

| Uses borrowed money | Yes | No |

| Interest risk | Yes (if unpaid) | No |

| Fraud protection | Strong | Moderate |

| Builds credit | Yes | No |

| Spending control | Requires discipline | Automatic |

| Beginner suitability | Medium (with plan) | High |

When debit cards make more sense

Use debit when:

- Budgeting discipline is the priority

- You’re rebuilding habits

- You want instant feedback on spending

Debit keeps mistakes small and visible.

When credit cards make more sense

Use credit when:

- Building credit history matters

- Purchases need protection

- Cash flow timing helps

Credit rewards organization—not impulse.

FAQs

Is a credit card better than a debit card for beginners?

It depends on discipline and goals; many beginners use both.

Can debit cards hurt my credit score?

No—debit activity doesn’t affect credit.

Should beginners avoid credit cards?

Not necessarily—use them carefully and pay in full.

What happens if my debit card is stolen?

Funds may be temporarily unavailable during disputes.

Do credit cards always charge interest?

No—only if balances aren’t paid in full.

Is it okay to have only a debit card?

Yes, especially early on—but credit can help later.

Conclusion

For beginners, credit cards vs debit cards isn’t a battle—it’s a balance. Debit cards provide control; credit cards provide protection and credit history. Used together, intentionally, they support safer spending and stronger financial foundations.

Internal link

External link