Introduction

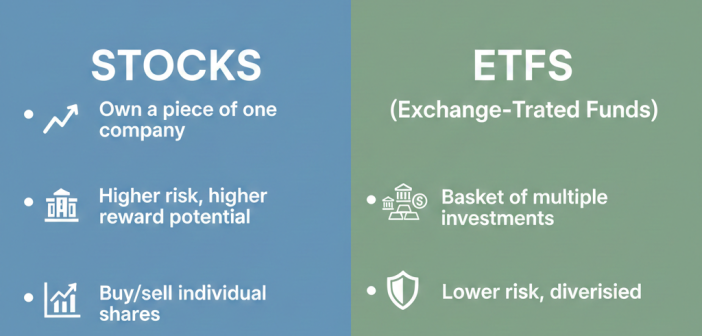

Stocks vs ETFs is the key decision many beginner investors face. Stocks represent ownership in a single company, while ETFs spread your money across many investments in one purchase. Choosing between them depends on your risk tolerance, time commitment, and investing style. This guide explains the differences, shows when each makes sense, highlights common beginner mistakes, and offers a practical approach for deciding without overthinking.

What stocks actually are (beyond the textbook definition)

When you buy a stock, you buy a piece of one company.

That means:

- Your returns depend on that company’s performance

- You benefit if it grows or pays dividends

- You carry the full risk of that single business

Stocks reward research, patience, and tolerance for ups and downs.

[Expert Warning] What beginners often overlook is concentration risk—one bad company decision can heavily impact your results.

What ETFs really are (and why they feel safer)

An ETF (Exchange-Traded Fund) is a basket of investments that trades like a stock.

An ETF can hold:

- Dozens or hundreds of stocks

- Bonds or mixed assets

- Entire market sectors or indexes

Instead of betting on one company, you’re spreading risk across many.

[Pro-Tip] From real market behavior, diversification—not prediction—is what protects beginner investors.

Stocks vs ETFs: the core differences

Ownership structure

- Stocks: One company

- ETFs: Many companies or assets

Risk exposure

- Stocks: Higher risk, higher potential volatility

- ETFs: Lower volatility due to diversification

Time commitment

- Stocks: Require monitoring and research

- ETFs: Can be more hands-off

Common beginner mistakes (and how to avoid them)

Mistake 1: Treating ETFs as “no-risk”

Fix: ETFs reduce risk, they don’t eliminate it.

Mistake 2: Buying stocks based on hype

Fix: Focus on fundamentals, not headlines.

Mistake 3: Over-diversifying too early

Fix: A few broad ETFs often outperform cluttered portfolios.

Information Gain: Why ETFs outperform most beginners’ stock picks

Top SERP pages explain what stocks and ETFs are, but miss why ETFs often win early on.

In practice:

- Most beginners underperform the market with individual stocks

- Broad ETFs capture market growth without constant decisions

- Fewer decisions = fewer emotional mistakes

ETFs reduce the need to be “right” all the time.

Real-world scenario: investing with limited time

In practical situations, investors with full-time jobs often choose ETFs because:

- They don’t require daily monitoring

- Market exposure is automatic

- Stress is lower during market swings

Stocks suit those who enjoy research and volatility.

Beginner mistake most people make

The biggest mistake is choosing stocks or ETFs exclusively. Many successful investors use ETFs as a foundation and add stocks gradually as experience grows.

How to choose between stocks and ETFs

Ask yourself:

- Do I enjoy researching companies?

- Can I tolerate sharp price swings?

- Do I want simplicity or control?

If you want simplicity → ETFs

If you want control and learning → Stocks

If unsure → Start with ETFs, add stocks later

[Money-Saving Recommendation] Beginner-friendly investing platforms often make ETF investing cheaper and easier than buying multiple individual stocks.

Table: Stocks vs ETFs side-by-side

| Feature | Stocks | ETFs |

| Diversification | Low | High |

| Risk level | Higher | Lower (relative) |

| Time required | High | Low–Medium |

| Beginner-friendly | Medium | High |

| Control | High | Medium |

| Volatility | High | Moderate |

When stocks make more sense than ETFs

Stocks may be better when:

- You understand the business deeply

- You want concentrated exposure

- You can hold through volatility

Stocks reward conviction—but punish impatience.

FAQs

Are ETFs safer than stocks?

Generally yes, because they’re diversified—but they still carry risk.

Can beginners invest only in ETFs?

Yes. Many do, especially early on.

Do ETFs pay dividends?

Some do, depending on what they hold.

Is it better to buy one ETF or many stocks?

For beginners, one broad ETF is often safer.

Can I lose money in ETFs?

Yes, especially in short time frames.

Should I switch from ETFs to stocks later?

You can add stocks as experience grows.

Conclusion

The difference between stocks and ETFs isn’t about which is better—it’s about fit. ETFs offer simplicity and diversification, while stocks offer control and learning. Most beginners succeed by starting simple and expanding as confidence grows.

Internal link

How Investing Works for Beginners (Simple & Real)

External link

Exchange-traded Funds (ETFs) | Vanguard