Introduction

Track expenses manually to gain real awareness of your spending, reduce impulse purchases, and build financial control without relying on apps or complex software. Manual expense tracking works because it slows spending enough to notice patterns, helping beginners develop lasting habits before introducing automation. In 2025, many people quit tracking because apps demand too much attention or hide insights. This guide explains simple methods to track expenses manually, common mistakes to avoid, and a realistic weekly routine that fits busy lives while improving financial decisions over time.ts.

Why manual expense tracking still works (and often works better)

track expenses Manual tracking slows spending just enough to create awareness. When you write numbers down yourself, you notice patterns apps often hide.

Manual tracking helps you:

Understand why you spend, not just where

Reduce impulse purchases

Stay conscious without constant notifications

Build habits before adding tools

[Pro-Tip] From real usage, people who start manually develop better spending instincts—even if they later switch to apps.

The core principle: awareness beats precision

track expenses You don’t need to record every coffee receipt.

Manual tracking works best when you:

Track categories, not items

Review totals, not transactions

Focus on patterns, not perfection

Accuracy improves naturally once awareness exists.

Three simple manual tracking methods (choose one)

1) Notebook method (lowest friction)

One page per week

Categories listed on the side

Update once daily or every other day

2) Notes app method (phone-friendly)

Create a simple checklist with category totals

Update on the go

Review weekly

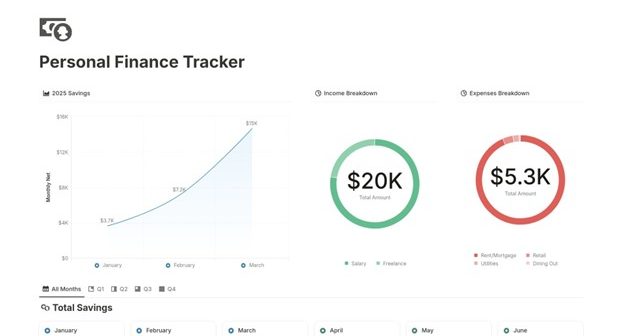

3) Spreadsheet-lite method

One sheet, one month

Columns for categories only

No formulas required

track expenses Choose the method that feels easiest to maintain—not the most impressive.

Common manual tracking mistakes (and fixes)

Mistake: Tracking every transaction forever

Fix: Track in phases. Awareness first, detail later if needed.

Mistake: Updating only at month-end

Fix: Shorter gaps reduce memory errors.

Mistake: Too many categories

Fix: Start with 5–7 categories max.

[Expert Warning] What beginners often overlook is category overload. Too many labels create friction and abandonment.

Information Gain: Why apps fail beginners

Top SERP results often recommend apps immediately. What they miss is habit readiness.

Apps fail when:

Users haven’t built review routines

Notifications replace reflection

Automation hides spending behavior

Manual tracking builds the foundation apps assume you already have.

Practical insight from experience (unique section)

In practical situations, the biggest improvement comes not from tracking more, but from reviewing better. A 10-minute weekly review does more for control than perfect daily logs. The habit of reflection—not the method—drives results.

How to run a 10-minute weekly expense review

Add up category totals

Compare to last week (not goals)

Identify one surprise

Adjust next week’s ranges

Keep it short. Consistency matters more than depth.

Table: Manual tracking vs app tracking

| Feature | Manual Tracking | App Tracking |

| Setup time | Very low | Medium |

| Awareness | High | Medium |

| Automation | Low | High |

| Beginner-friendly | Very high | Medium |

| Long-term flexibility | High | High |

When to add tools (and when not to)

Add tools only when they reduce effort you already feel:

Automatic savings

Bill reminders

Category summaries

At that point, exploring beginner-friendly financial tools or accounts can enhance—not replace—your habits.

[Money-Saving Recommendation] Avoid paid apps early. Free manual methods outperform expensive tools without habits.

FAQs

Is manual expense tracking effective?

Yes. It improves awareness and control with minimal effort.

How often should I update expenses?

Every 1–2 days works best.

How many categories should I use?

Start with 5–7 and adjust later.

Do I need receipts?

No. Totals matter more than proof.

How long should I track manually?

At least one full month for pattern clarity.

Can I switch to apps later?

Yes. Manual tracking builds the foundation apps need.

Internal link

How to Create a Monthly Budget Step by Step (Realistic

External link